|

Email: financeandtaxes@yahoo.com

|

FINNTAXES.COM - GST, INCOME TAX AND FINANCE SERVICES PROVIDERS

FINNTAXES.COM is a platform where individual and firm can benefit the services we are providing from PANCARD, GST, INCOME TAX RETURN,

BALANCE SHEETS CREATION, AUDIT SERVICES, NET WORTH, BOOKING KEEPING etc. under one roof. We are complete tax service solutions. If you can't beat taxes, let us handle them.

Leave your stressful tax problems to us.

|

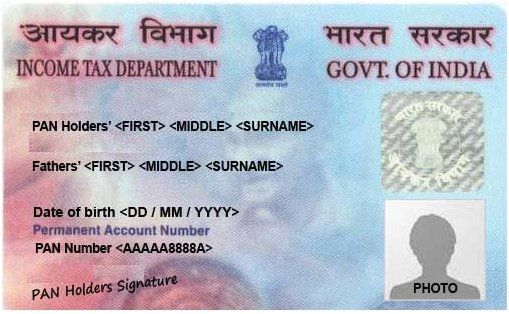

PAN CARD CONSULTANT SERVICES

Want to apply for PAN card online? FINNTAXES.COM helps you in PAN card apply online process.

FINNTAXES.COM provides all kinds of service such as online

PAN card application, duplicate PAN card,

reprint PAN card, changing name in PAN card, linking PAN with Aadhar.

Permanent Account Number (PAN) is a ten-digit alphanumeric number, issued in the form of a laminated card, by

the

Income Tax Department. All existing assesses or taxpayers or persons who are required to furnish a return of income,

even on behalf of others, must obtain PAN.

It is mandatory to

quote PAN on return of income, all correspondence with any income tax authority.

From 1 January 2005 it will be mandatory to quote PAN on challans for any payments due to Income Tax Department.

It is also compulsory to quote PAN in all documents pertaining to

financial transactions notified from time-to-time

by the Central Board of Direct Taxes. Some such transactions are sale and purchase of immovable property or motor

vehicle or payments in cash, of amounts exceeding Rs. 25,000/-to hotels and restaurants or in connection with travel

to any foreign country. It is also mandatory to mention PAN for obtaining a telephone or cellular telephone connection. Likewise, PAN has to be

mentioned for making a time deposit exceeding Rs. 50,000/- with a Bank or Post Office or depositing cash of Rs. 50,000/- or more in a Bank.

DOCUMENTS REQUIRED FOR NEW PAN CARD APPLICATION FOR INDIVIDUALS & HUF:

Following are the documents required for new PAN card application:

1. One recent, coloured photograph (Stamp Size: 3.5 cms x 2.5 cms)

1. One recent, coloured photograph (Stamp Size: 3.5 cms x 2.5 cms)

2. Proof of Identity

2. Proof of Identity

3. Proof of Address

3. Proof of Address

4. Proof of date of birth

4. Proof of date of birth

PROOF OF IDENTITY

Copy of any of the following documents bearing name of the applicant as mentioned in the application:-

Aadhaar Card issued by the Unique Identification Authority of India; or

Aadhaar Card issued by the Unique Identification Authority of India; or

Elector’s photo identity card; or

Elector’s photo identity card; or

Driving License; or

Driving License; or

Passport

Passport

Ration card having photograph of the applicant; or

Ration card having photograph of the applicant; or

Arm’s license; or

Arm’s license; or

Photo identity card issued by the Central Government or State Government or Public Sector Undertaking; or

Photo identity card issued by the Central Government or State Government or Public Sector Undertaking; or

Pensioner card having photograph of the applicant; or

Pensioner card having photograph of the applicant; or

Central Government Health Scheme Card or Ex-Servicemen Contributory Health Scheme photo card

Central Government Health Scheme Card or Ex-Servicemen Contributory Health Scheme photo card

Certificate of identity in Original signed by a Member of Parliament or Member of Legislative Assembly or Municipal Councilor or a Gazetted officer (iii) Bank certificate in Original on letter head from the branch(along with name and stamp of the issuing officer) containing duly attested photograph and bank account number of the applicant. Send us the document online and we will start working. PROOF OF ADDRESS:

(i) Copy of any of the following documents bearing the address mentioned in the application:-

Aadhaar Card issued by the Unique Identification Authority of India; or

Aadhaar Card issued by the Unique Identification Authority of India; or

Elector’s photo identity card; or

Elector’s photo identity card; or

Driving License; or

Driving License; or

Passport

Passport

Passport of the spouse; or

Passport of the spouse; or

Post office passbook having address of the applicant; or

Post office passbook having address of the applicant; or

Latest property tax assessment order; or

Latest property tax assessment order; or

Domicile certificate issued by the Government; or

Domicile certificate issued by the Government; or

Allotment letter of accommodation issued by the Central Government or State Government of not more than three years old; or

Allotment letter of accommodation issued by the Central Government or State Government of not more than three years old; or

Property Registration Document; or

Property Registration Document; or

PROOF OF DATE OF BIRTH

Copy of any of the following documents bearing the name, date, month and year of birth of the applicant as mentioned in the application:-

Aadhaar card issued by the Unique Identification Authority of India; or

Aadhaar card issued by the Unique Identification Authority of India; or

Elector’s photo identity card; or

Elector’s photo identity card; or

Driving License; or

Driving License; or

Passport

Passport

Matriculation certificate or Mark sheet of recognized board; or

Matriculation certificate or Mark sheet of recognized board; or

Birth certificate issued by the municipal authority or any office authorised to issue birth certificate

Birth certificate issued by the municipal authority or any office authorised to issue birth certificate

Photo identity card issued by the Central Government or State Government or Central Public Sector Undertaking or State Public Sector Undertaking; or

Photo identity card issued by the Central Government or State Government or Central Public Sector Undertaking or State Public Sector Undertaking; or

Domicile certificate issued by the Government; or

Domicile certificate issued by the Government; or

Central Government Health Service Scheme photo card or Ex-servicemen Contributory Health Scheme photo card; or

Central Government Health Service Scheme photo card or Ex-servicemen Contributory Health Scheme photo card; or

Pension payment order; or

Pension payment order; or

Marriage certificate issued by the Registrar of Marriages; or

Marriage certificate issued by the Registrar of Marriages; or

Affidavit sworn before a magistrate stating the date of birth.

Affidavit sworn before a magistrate stating the date of birth.

FINNTAXES.COM is an eminent business platform and a progressive concept, which helps end-to-end incorporation,

compliance, advisory, and management consultancy services to clients in India and abroad.

Filing online Income Tax Returns (IT Return filing) is easy, seamless, cheapest and quickest with

FINNTAXES.COM! Apart from Income Tax returns, FINNTAXES also helps you to file GST Returns, TDS Returns,

PF Returns and ESI Returns easily.

If you are looking for any Pan card Services or GST, ITRs Experts anywhere, You can write to us at - financeandtaxes@yahoo.com.

Get all your business related solutions under one roof. Taxation, Accounting, Management. You name it,

and we have got you covered. Moreover, you will never have to physically meet us as all of our services are carried out online.

Get things done quickly with a few clicks and minimum time. From our website to our process everything is designed

keeping your convenience as our priority. Our utterly digital process makes your experience smoother and faster.

FINNTAXES.COM provides the finance and taxation services for your business at very minimal prices. Go Paperless with FINNTAXES.COM and email us - financeandtaxes@yahoo.com |

|

|

NEED GST NUMBER, INCOME TAX RETURN FILING OR TRADEMARK REGISTRATION - EMAIL: financeandtaxes@yahoo.com |

| |

|

| |

|

WEBSITE DESIGN, DEVELOP AND MARKETED BY -

https://www.vaishnogsoftwares.com/

|

Copyright© FINNTAXXES.COM

|