|

Email: financeandtaxes@yahoo.com

|

FINNTAXES.COM - GST, INCOME TAX AND FINANCE SERVICES PROVIDERS

FINNTAXES.COM is a platform where individual and firm can benefit the services we are providing from PANCARD, GST, INCOME TAX RETURN,

BALANCE SHEETS CREATION, AUDIT SERVICES, NET WORTH, BOOKING KEEPING etc. under one roof. We are complete tax service solutions. If you can't beat taxes, let us handle them.

Leave your stressful tax problems to us.

|

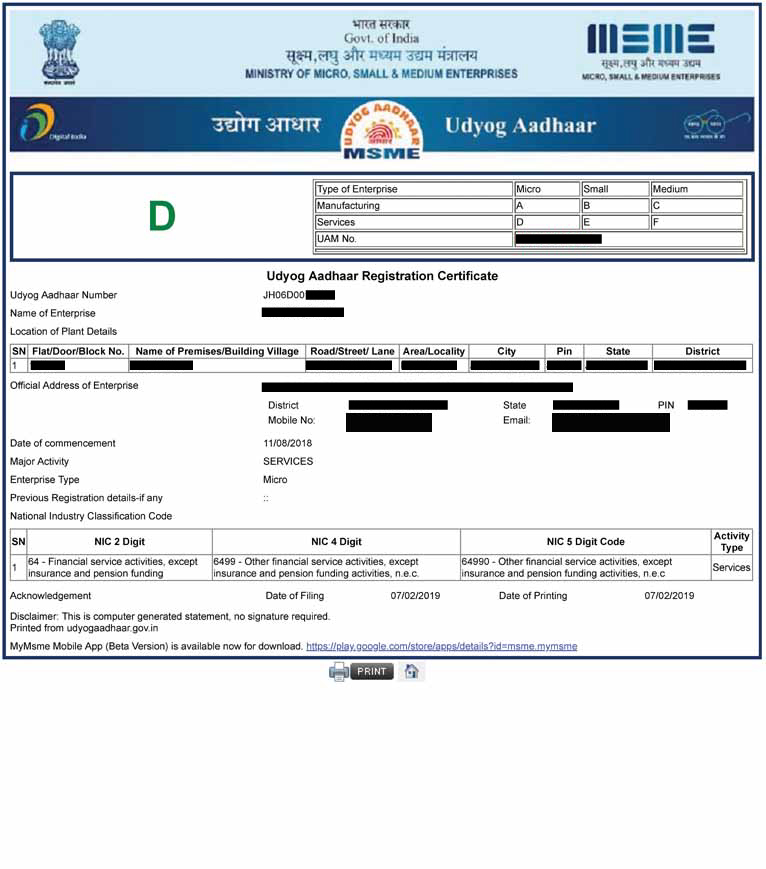

MSME REGISTRATION SERVICES

MSME stands for Micro, Small and Medium Enterprises. In a developing country like India,

MSME industries are the backbone of the economy. When these industries grow, the economy of

the country grows as a whole and flourishes. These industries are also known as small-scale industries or SSI’s.

MSME registration helps these industries to obtain the various benefits provided by the government to MSMEs.

Even if the company is in the manufacturing line or the service line, MSME registration for both these industry sectors can be

obtained as per the MSME Act. The MSME registration is not yet made mandatory by the Government of India but it is beneficial to get one’s

business registered under this because it provides a lot of benefits in terms of

taxation, setting up the business, credit facilities, loans etc.

The MSME Act became operational in 2006. It aims to promote, facilitate and develop the competitiveness of micro, small and medium enterprises in India. It is due to this very fact that they’re so crucial to our economic development and the reason why they’ve constantly been in the news ever since the pandemic struck in early 2020. However, as the pandemic subsides and the economy is slowly brought back to life, it presents a greater opportunity for business owners to get their MSME registrations done and avail a wide array of benefits.

BENEFITS OF MSME REGISTRATION:

Some of the other added benefits of getting your MSME registered under the provisions of these laws are summarised in the section below.

DOCUMENTS FOR REGISTRATIONS

1. Bank Loans (Collateral Free)

1. Bank Loans (Collateral Free)

The Government of India has made collateral-free credit available to all small and micro-business sectors. This initiative guarantees funds to micro and small sector enterprises. Under this scheme, both the old as well as the new enterprises can claim the benefits. A trust named The Credit Guarantee Trust Fund Scheme was introduced by the Government Of India, SIDBI(Small Industries Development Bank Of India) and the Ministry of Micro, Small and Medium Enterprise to make sure this scheme is implemented (Credit Guarantee Scheme) for all Micro and Small Enterprises.  2. Subsidy on Patent Registration

2. Subsidy on Patent Registration

Under the current laws, MSMEs registered with the MSME ministry stand to benefit from a 50% subsidy on their patent registration fees. This encourages small businesses and firms to keep innovating and working on new projects and technologies. The subsidy can be availed by submitting an application to the respective ministries.  3. Overdraft Interest Rate Exemption

3. Overdraft Interest Rate Exemption

Businesses and enterprises registered as MSMEs can avail a benefit of 1% on the OverDraft in a scheme that differs from bank to bank. This helps to make small businesses secure during unfavorable markets.  4. Industrial Promotion Subsidy Eligibility

4. Industrial Promotion Subsidy Eligibility

Businesses that have been registered as MSMEs are eligible for subsidies for Industrial Promotion as provided by the Government.  5. Protection against Payments (Delayed Payments)

5. Protection against Payments (Delayed Payments)

MSMEs constantly face the risk of delayed payments which in turn disturbs their entire business. In order to protect registered companies, the Supreme Court has mandated that any buyer of goods or services from registered MSMEs is required to make the payment on or before the agreed date of payment or within 15 days from the day they had accepted the goods or services. If the buyer delays the payment for more than 45 days after accepting the products or services then the buyer has to pay interest on the amount that was agreed to be paid. The interest rate is three times the rate that is notified by the Reserve Bank of India.  6. Fewer Electricity Bills

6. Fewer Electricity Bills

All companies that have the MSME Registration Certificate are entitled to concessions on their electric bill. This enables businesses to boost production and take in more orders without worrying about capital expenditure on costs like electricity and maintenance. micro, small and medium enterprises can avail of the concession by providing an application to the department of electricity along with the certificate of registration.  7. Tenders

7. Tenders

The Government reserves tenders particularly to the MSMEs in order to promote their growth. In order to help these industries advance technologically, a scheme called the Credit Linked Subsidy scheme is in force for the up-gradation and utilization of technology by these establishments.  8. Easy licensing and approvals

8. Easy licensing and approvals

Those enterprises which produce the Certificate of MSME Registration while making applications for licenses, approvals, and registrations on any field for their business from the respective authorities then, they are given priority and the process has been more simplified for them.  9. Protection against delay in payment

9. Protection against delay in payment

The MSME ministry has given protection to UDYAM Registered Businesses against delay in payments from Buyers and right of interest on delayed payment through mediation, arbitration, and settlement of disputes in the least possible time. If any UDYAM registered micro or small enterprise supplies any goods or services, then it is incumbent upon the buyer to make the payment on or before the agreed date. Where there is no agreement, then the buyer is required to make the payment within fifteen days of acceptance of goods or services. Further, a payment due to a micro or small enterprise has to be made within a maximum of forty-five days from the day of acceptance or the day of deemed acceptance. If a buyer fails to do so then, the buyer is liable to pay interest, compounded monthly from the agreed date of payment or fifteen days of acceptance of goods or services. The penal interest charged from the buyer for delayed payment to an MSME enterprise is three times the bank rate notified by the Reserve Bank of India.

The registration will require the business head or entrepreneur to submit a few documents like

Aadhar card

Aadhar card

PAN card

PAN card

Number of employees

Number of employees

Place of organization

Place of organization

Investment turnover per year

Investment turnover per year

The registration of the company is quite beneficial in many aspects of the business. This process qualifies them for subsidies offered under the MSME Development Act. The central and state governments and union territories have developed unique packages and offer various benefits under schemes directed towards expansion and greater economic contribution from these enterprises. Send us the document online and we will start working.

FINNTAXES.COM is an eminent business platform and a progressive concept, which helps end-to-end incorporation,

compliance, advisory, and management consultancy services to clients in India and abroad.

Filing online Income Tax Returns (IT Return filing) is easy, seamless, cheapest and quickest with

FINNTAXES.COM! Apart from Income Tax returns, FINNTAXES also helps you to file

GST Returns,

TDS Returns,

PF Returns and ESI Returns easily.

If you are looking for any MSME registration Services or and IT Experts anywhere, You can write to us at - financeandtaxes@yahoo.com.

Get all your business related solutions under one roof. Taxation, Accounting, Management. You name it,

and we have got you covered. Moreover, you will never have to physically meet us as all of our services are carried out online.

Get things done quickly with a few clicks and minimum time. From our website to our process everything is designed

keeping your convenience as our priority. Our utterly digital process makes your experience smoother and faster.

FINNTAXES.COM provides the finance and taxation services for your business at very minimal prices. Go Paperless with FINNTAXES.COM and call us on email us - financeandtaxes@yahoo.com |

|

|

NEED GST NUMBER, INCOME TAX RETURN FILING OR TRADEMARK REGISTRATION - EMAIL: financeandtaxes@yahoo.com |

| |

|

| |

|

WEBSITE DESIGN, DEVELOP AND MARKETED BY -

https://www.vaishnogsoftwares.com/

|

Copyright© FINNTAXXES.COM

|